All about Feie Calculator

Table of ContentsEverything about Feie CalculatorSee This Report about Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.The Definitive Guide for Feie CalculatorTop Guidelines Of Feie CalculatorSome Of Feie CalculatorThe Feie Calculator Ideas

If he 'd frequently taken a trip, he would certainly rather finish Component III, detailing the 12-month duration he satisfied the Physical Visibility Examination and his traveling history. Step 3: Coverage Foreign Income (Part IV): Mark made 4,500 per month (54,000 each year).Mark calculates the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his salary (54,000 1.10 = $59,400). Since he resided in Germany all year, the percentage of time he lived abroad during the tax obligation is 100% and he goes into $59,400 as his FEIE. Mark reports total incomes on his Kind 1040 and enters the FEIE as an unfavorable quantity on Schedule 1, Line 8d, decreasing his taxed income.

Selecting the FEIE when it's not the best alternative: The FEIE might not be perfect if you have a high unearned income, earn greater than the exclusion limit, or live in a high-tax country where the Foreign Tax Credit Report (FTC) might be more advantageous. The Foreign Tax Credit Score (FTC) is a tax obligation reduction technique typically utilized combined with the FEIE.

Feie Calculator Fundamentals Explained

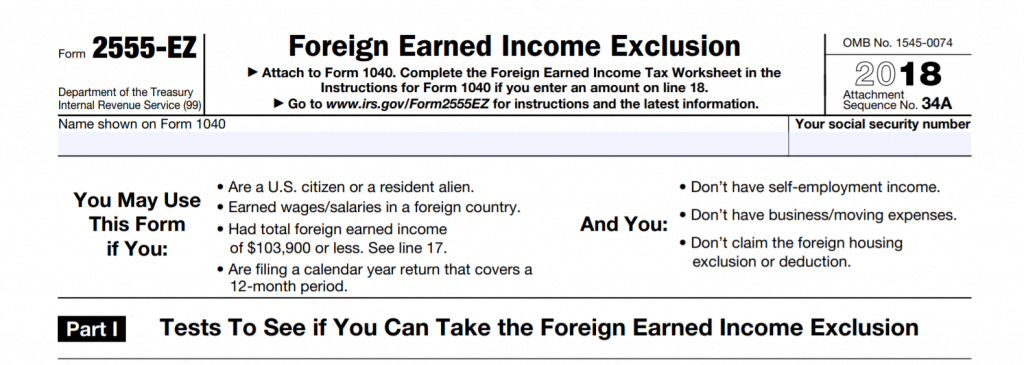

deportees to offset their united state tax financial debt with foreign earnings tax obligations paid on a dollar-for-dollar reduction basis. This indicates that in high-tax countries, the FTC can commonly remove united state tax obligation financial debt totally. The FTC has constraints on qualified tax obligations and the optimum insurance claim amount: Eligible tax obligations: Only income taxes (or taxes in lieu of earnings tax obligations) paid to foreign governments are eligible (Form 2555).

tax obligation obligation on your international income. If the international taxes you paid exceed this limit, the excess international tax obligation can normally be carried onward for approximately 10 years or lugged back one year (through a changed return). Keeping accurate records of international income and taxes paid is for that reason crucial to determining the proper FTC and preserving tax obligation compliance.

migrants to reduce their tax responsibilities. For example, if an U.S. taxpayer has $250,000 in foreign-earned income, they can leave out up to $130,000 making use of the FEIE (2025 ). The continuing to be $120,000 may after that go through tax, but the united state taxpayer can possibly use the Foreign Tax Credit to balance out the tax obligations paid to the foreign nation.

Feie Calculator Fundamentals Explained

He sold his United state home to establish his intent to live abroad completely and used for a Mexican residency visa with his partner to aid meet the Bona Fide Residency Test. Neil aims out that purchasing residential property abroad can be challenging without initial experiencing the area.

"It's something that people need to be actually attentive concerning," he states, and recommends deportees to be careful of typical mistakes, such as overstaying in the U.S.

Neil is careful to cautious to Tension tax united state tax obligation "I'm not conducting any performing any kind of Organization. The United state is one of the couple of countries that taxes its residents regardless of where they live, indicating that even if an expat has no revenue from U.S.

Little Known Facts About Feie Calculator.

tax return. "The Foreign Tax Credit allows individuals working in high-tax countries like the UK to counter their United state tax obligation liability by the amount they've currently paid in taxes abroad," says Lewis.

The prospect of lower living costs can be appealing, but it commonly comes with compromises that aren't quickly obvious - https://www.huntingnet.com/forum/members/feiecalcu.html?simple=1#aboutme. Real estate, for instance, can be much more budget-friendly in some nations, but this can suggest endangering on framework, safety, or access to trusted utilities and solutions. Cost-effective residential or commercial properties could be situated in areas with inconsistent internet, minimal mass transit, or undependable healthcare facilitiesfactors that can significantly influence your daily life

Below are some of the most frequently asked questions about the FEIE and various other exemptions The Foreign Earned Income Exclusion (FEIE) permits U.S. taxpayers to omit up to $130,000 of foreign-earned earnings from government revenue tax, reducing their united state tax responsibility. To receive FEIE, you should fulfill either the Physical Existence Examination (330 days abroad) or the Authentic House Test (prove your main residence in a foreign country for an entire tax year).

The Physical Visibility Test additionally calls for United state taxpayers to have both a foreign earnings and a foreign tax home.

Some Known Details About Feie Calculator

An income tax treaty in between the U.S. and one more nation can assist stop dual taxes. While the Foreign Earned Earnings Exemption lowers gross income, a treaty may offer additional benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for declare U.S. residents with over $10,000 in international financial accounts.

The international earned income exclusions, in some cases described as the Sec. 911 exclusions, leave out tax on earnings earned from working abroad. The exclusions consist of 2 components - a revenue exemption and a real estate exclusion. The complying with Frequently asked questions discuss the advantage of the exclusions including when both partners are expats in a basic fashion.

Rumored Buzz on Feie Calculator

The earnings exemption is now indexed for inflation. The maximum yearly revenue exclusion is $130,000 for 2025. The tax obligation benefit leaves out the revenue from tax obligation at bottom tax prices. Formerly, the exclusions "came off the top" minimizing earnings based on tax obligation on top tax prices. The exemptions may or might not minimize income utilized for various other functions, such as individual retirement account restrictions, child credit reports, individual exceptions, etc.

These exclusions do not excuse the incomes from US tax but merely provide a tax obligation reduction. Note that a bachelor functioning abroad for all of 2025 who made about $145,000 without other earnings will certainly have taxable revenue lowered to zero - efficiently the very same solution as being "free of tax." The exemptions are computed each day.

If you attended company meetings or workshops in the US while living abroad, earnings for those days can not be omitted. For United States tax obligation it does not matter where you keep your funds - you are taxable on your worldwide income as an US person.